Private lenders face mounting pressure to accelerate loan decisions while maintaining rigorous risk management standards. Every day spent waiting for title updates means potential deals lost to competitors and increased borrower frustration. That's why Sekady has integrated with AFX Research to deliver fast, accurate title update reports directly within your existing draw and inspection management workflow.

Complete Due Diligence, Seamless Workflow

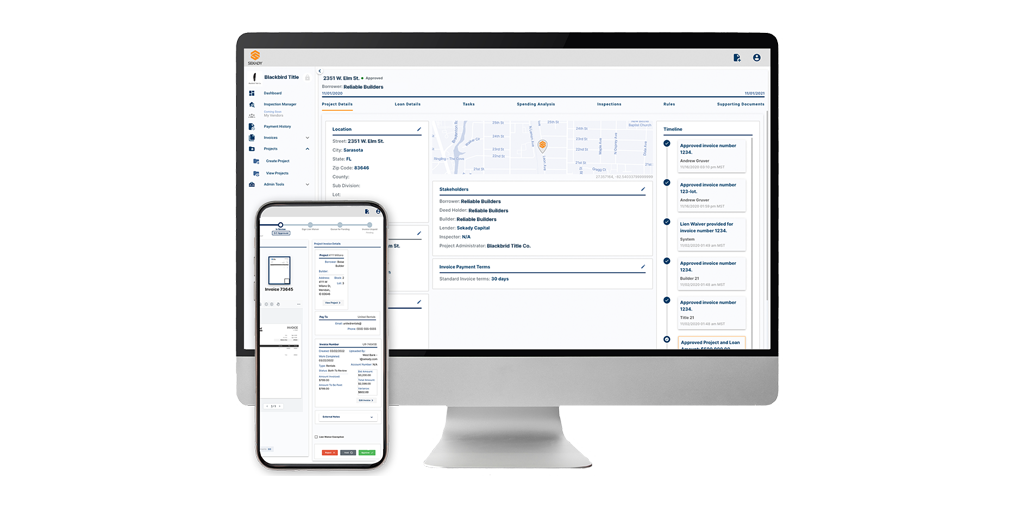

Sekady's draw management platform already handles the complex coordination of construction loan disbursements, from tracking project milestones to managing contractor payments. Now, with integrated AFX title updates, lenders can verify clear title status without leaving the platform or disrupting their established processes.

The integration eliminates the typical delays that plague construction lending. Instead of requesting title updates through separate channels and waiting days for responses, lenders can access AFX's nationwide title data instantly. This means faster draw approvals and more confident lending decisions at every stage of the construction process.

Inspection Management Meets Title Intelligence

Construction projects evolve rapidly, and title issues can emerge unexpectedly. Sekady's inspection management capabilities now work in tandem with AFX's comprehensive title monitoring. When your field inspectors verify construction progress, you can simultaneously confirm that no new liens, judgments, or other title clouds have appeared since your last review.

This dual-layer approach significantly reduces risk exposure. Mechanical liens, in particular, can appear quickly during active construction, potentially jeopardizing your loan position. With AFX's fast, accurate reporting integrated into your inspection workflow, you'll catch these issues before they become costly problems.

Why AFX Research Makes the Difference

AFX Research brings three critical advantages to construction lending: speed, nationwide coverage, and accuracy. Their title update reports deliver comprehensive results in hours, not days, covering all 50 states with consistent reliability. For private lenders managing portfolios across multiple markets, this consistency is invaluable.

The accuracy of AFX reports means fewer surprises at closing and reduced legal complications. Their thorough search capabilities uncover potential issues that might slip through less comprehensive services, giving you the confidence to fund draws and move projects forward.

Built for Private Lender Success

Private construction lenders operate in a competitive environment where speed and accuracy determine success. The Sekady-AFX integration recognizes this reality by delivering title intelligence exactly when and where you need it most—integrated into your draw management process, available during inspection reviews, and accessible through a single, familiar interface.

Whether you're funding a single-family spec home or a multi-million-dollar commercial development, having immediate access to current title information transforms your risk management capabilities. You can approve draws with confidence, identify potential issues before they escalate, and maintain the responsive service that keeps borrowers coming back.

The construction lending landscape demands tools that work as hard and as fast as you do. With Sekady's comprehensive draw and inspection management enhanced by AFX's title intelligence, you have everything needed to stay ahead of the competition while protecting your portfolio.

Ready to see how integrated title updates can accelerate your construction lending process? Contact Sekady today to learn more about the AFX Research integration.